The PAN card issued by the Income Tax Department is a very special document which is mainly linked to financial banks. Under the PAN card, all types of transactions from opening a bank account to other transactions are done very easily.

Such persons who open an account in any bank branch or do any other related work, will compulsorily require a PAN card as per the government rules, which is very important to get.

Let us tell you that most of the people apply for PAN card in offline offices only, but for those people who need PAN card immediately and need to wait for one or two days, it becomes very difficult to get PAN card offline.

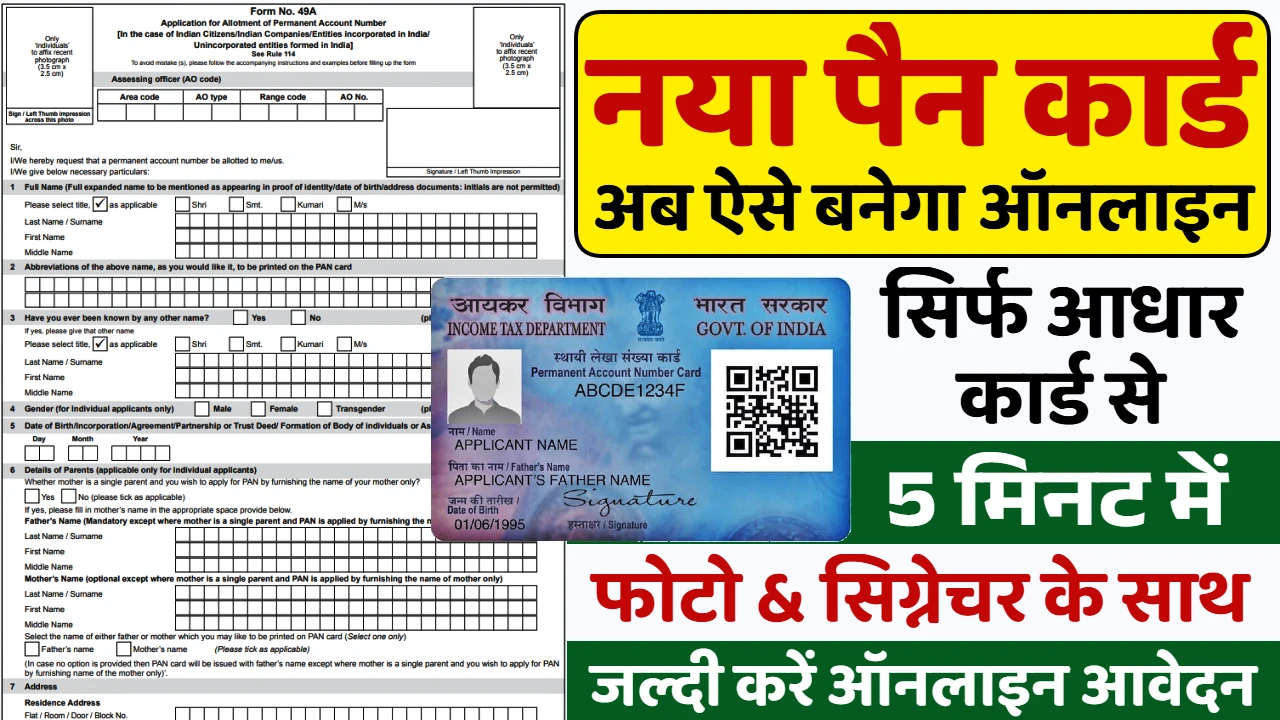

PAN Card Online Apply 2025

To provide instant facilities to the people and to solve the time and other types of errors in the offline application process, the online application process for making PAN card has been started. Yes, you can also get your PAN card made through online medium.

To apply for PAN card through online medium, one does not have to stand in long queues in government offices, rather one can apply from home and just submit the receipt of the application, in this way PAN card can be ready in a short time.

PAN Card Apply Online 2025 Overview

| Department Name | Income Tax Department |

| Name of the document | PAN card |

| Name of the form | 49a |

| Year | 2025 |

| utility | An essential document for financial transactions and identification |

| Application Fee | 107 rupees |

| Application | Through online mode |

| Category | Government Schemes |

| official website | https://incometaxindia.gov.in/ |

Materials required for making PAN card

To get a PAN card, some essential materials i.e. documents are also required on the basis of which the application for PAN card is approved. The documents required for getting a PAN card are from the government:-

- Identification Card

- Aadhar card

- Birth Certificate

- Passport size photo

- Mobile number, etc.

Application Fee for PAN Card

For your information, let us tell you that officially a different type of PAN card is made for Indian citizens, apart from this, a different type of PAN card has been implemented for foreign citizens to carry out transactions in India. Different fees have to be paid for both types of PAN cards at the time of applying.

People who are Indian citizens and want to get a PAN card made have to pay only Rs. 107 as application fee through online mode. Apart from this, foreigners may have to pay more than ₹1000 to get a PAN card with an Indian address.

Features of PAN Card Document

The features of the PAN card document generated by the Income Tax Department are as follows:-

- Once the PAN card is made officially, it is valid for life.

- PAN card also serves as an ID proof document for people.

- PAN card keeps all types of financial transactions completely safe and transparent.

- PAN card plays an important role in financial transactions, business registration and other related legal and illegal activities.

How much time does it take to get a PAN card after applying?

Such people who have applied for making PAN card document for urgent work and want to know when the PAN card will be ready, then for their information let us tell you that it takes a maximum of one week to get the PAN card made through online medium.

After the PAN card is prepared within the stipulated time, it is sent to the applicant’s permanent address by this post office so that they do not have to face any hassle in getting their PAN card.

How to apply for PAN card online?

- To get PAN card online, visit the official website https://incometaxindia.gov.in/.

- You will have to click on the New Pen option on the official website.

- Now go ahead and select the PAN card form as per your choice.

- After the form is selected, all the information will have to be entered in it.

- After this, the applicant’s documents will have to be uploaded and the OTP verification work will have to be completed.

- Finally submit the form, after which you will get the registration number.

- In this way one can apply for PAN card.

FAQs

What is the form for Indian PAN card?

There is a form of 49a for Indian PAN card.

How to pay fees for PAN card?

The fee for PAN card can be paid through online payment application or net banking.

How to use PAN card instantly?

You can use it instantly based on the acknowledgement received after applying for PAN card.